MattJMM2

CapitalStrength.com

1919 Posts

user info

edit post |

Actually, given dates he said that, the price of a gallon of gas and the price of silver may have been much closer to 1dime.

The imaginary liberal I was being sarcastic with was you. Or am I wrong in thinking that you want to stimulate the economy by giving out more entitlements?

[Edited on March 20, 2012 at 11:59 AM. Reason : ;]  3/20/2012 11:57:35 AM 3/20/2012 11:57:35 AM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

You mean 16 days ago?

http://www.youtube.com/watch?feature=player_embedded&v=JHMe8NotFJQ  3/20/2012 11:59:16 AM 3/20/2012 11:59:16 AM

|

MattJMM2

CapitalStrength.com

1919 Posts

user info

edit post |

I am not going to research break down the price of silver and copper on those dates, find the average gas price for the day, to validate the accuracy of a statement that was meant to illustrate the shittiness of fiat currency.

Want to know why? Because I am going to go interview a potential employee for my business.  3/20/2012 12:01:53 PM 3/20/2012 12:01:53 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

You don't have to do any of that to know that the value of the dollar has not halved in the past 16 days.  3/20/2012 12:15:48 PM 3/20/2012 12:15:48 PM

|

pack_bryan

Suspended

5357 Posts

user info

edit post |

| Quote : | | "t the value of the dollar has not halved in the past 16 days." |

awww man. you could have told me that earlier. now i'm fucked. 3/20/2012 3:11:28 PM 3/20/2012 3:11:28 PM

|

McDanger

All American

18835 Posts

user info

edit post |

| Quote : | | "The imaginary liberal I was being sarcastic with was you. Or am I wrong in thinking that you want to stimulate the economy by giving out more entitlements?" |

"giving out entitlements" is a good way of putting it seeing as how you're recognizing your own entitlement 3/20/2012 4:26:55 PM 3/20/2012 4:26:55 PM

|

MattJMM2

CapitalStrength.com

1919 Posts

user info

edit post |

That one went over my head. Care to reiterate so a knuckle dragging meathead like myself can understand?

And if you are too fucking dense, in this context entitlement is synonymous with giving hand outs by the government. And more specifically, the handing out of debt to the lower class in an effort to stimulate growth without somehow debasing our currency even more.  3/20/2012 4:35:19 PM 3/20/2012 4:35:19 PM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

I think what you need to do, matt and mcdanger, is write a flow chart of your logic and upload it here.

Then we can visually see where you overlap and disagree.

[Edited on March 20, 2012 at 4:44 PM. Reason : .]  3/20/2012 4:43:36 PM 3/20/2012 4:43:36 PM

|

pack_bryan

Suspended

5357 Posts

user info

edit post |

3/20/2012 5:17:27 PM 3/20/2012 5:17:27 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

| Quote : | | "That one went over my head. Care to reiterate so a knuckle dragging meathead like myself can understand?" |

Hey how's that silver investment you made three weeks ago doing? 3/20/2012 6:24:54 PM 3/20/2012 6:24:54 PM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

3/20/2012 6:30:37 PM 3/20/2012 6:30:37 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

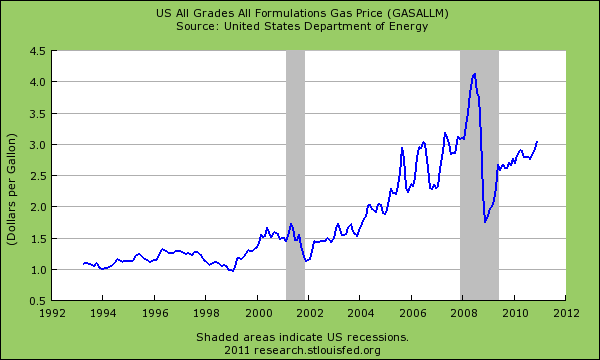

Yo, those charts don't show a doubling in the past 16 days, they must be out of date. That or Ron Paul's full of shit and there's more to rising gas prices than monetary inflation.

[Edited on March 20, 2012 at 6:33 PM. Reason : .]  3/20/2012 6:32:03 PM 3/20/2012 6:32:03 PM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

[Edited on March 20, 2012 at 6:44 PM. Reason : .]

3/20/2012 6:43:44 PM 3/20/2012 6:43:44 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

What?  3/21/2012 10:34:21 AM 3/21/2012 10:34:21 AM

|

pack_bryan

Suspended

5357 Posts

user info

edit post |

wow. all the way back to 1976. what a fucking tool jackass douchebag

[Edited on March 21, 2012 at 10:49 AM. Reason : ,]  3/21/2012 10:48:29 AM 3/21/2012 10:48:29 AM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

3/21/2012 10:52:03 AM 3/21/2012 10:52:03 AM

|

MattJMM2

CapitalStrength.com

1919 Posts

user info

edit post |

| Quote : | | "Yo, those charts don't show a doubling in the past 16 days, they must be out of date. That or Ron Paul's full of shit and there's more to rising gas prices than monetary inflation." |

Of course there are more factors than just monetary inflation. Supply, demand, speculation, etc. are all major affectors.

We live in the real world, where its almost impossible to account for all variables.

Are you contending that as more dollars start to circulate by the fed waving its magical wand of debt, that it won't devalue its buying power? 3/21/2012 11:39:43 AM 3/21/2012 11:39:43 AM

|

d357r0y3r

Jimmies: Unrustled

8198 Posts

user info

edit post |

QE is coming, could be as soon as April. When it's announced, that's when silver/gold makes the next jump.

The Fed has no choice but to engage in more QE.  3/21/2012 12:17:08 PM 3/21/2012 12:17:08 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

| Quote : | | "Are you contending that as more dollars start to circulate by the fed waving its magical wand of debt, that it won't devalue its buying power?" |

No, I'm contending that Ron Paul's "silver dime" remark is about 30 years past being incorrect. You're trying to expand this to a broader discussion to avoid admitting that.

When you use hyperbolic falsehoods to "illustrate a point" all you're illustrating is that you're exaggerating a problem and your dimwitted followers wont bother to factcheck you because their confirmation bias is so out of wack.

[Edited on March 21, 2012 at 12:30 PM. Reason : .] 3/21/2012 12:29:50 PM 3/21/2012 12:29:50 PM

|

d357r0y3r

Jimmies: Unrustled

8198 Posts

user info

edit post |

Silver was over 50 dollars an ounce at one point, and I'm certain that it will hit 50/ounce again in the next year or two. When silver was at its high recently, gas was 2-2.50 a gallon, so I don't think the claim was wildly inaccurate.  3/21/2012 12:44:59 PM 3/21/2012 12:44:59 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

You're kidding right?

First, you're basically saying that at this one point in time, when silver was exceptionally high and gas prices were still recovering from the crash, a silver dime would have bought you a gallon of gas. How that, a period of time that would at best span a few weeks with exceptional circumstances, translates into a talking about about the general dangers of inflation, is beyond me. It'd be an extremely blatant case of cherrypicking to make hay.

Even if that were true (this IS the kind of thing you could prove if you weren't a lazy prognosticator), that one point in time doesn't mean you can keep saying that talking point weeks, months, years after it ceased to be true.

Here's an idea: Rather than twist your mind into further pretzels trying to find a bizarre extra dimension from which you can peer at the statement and it becomes true-ish, consider the possibility that maybe Paul is a politician and as such says shit that isn't quite true, relying on his supporters to do the legwork of post-hoc rationalizing his questionable statements.

edit: Actually I'm just gonna go ahead and prove it wrong

| Quote : | | "When silver was at its high recently, gas was 2-2.50 a gallon" |

Last time silver reached near 50 was in 2011, as you can see in GXB's chart.

As you can see in this chart:

The last time gas was 2-2.50 a gallon was in 2009.

"When silver was at its high recently, gas was 2-2.50 a gallon" is simply false.

The last time "A silver dime can buy a gallon of gas" was true was probably more than a decade ago at least.

So maybe Paul is willfully fabricating this. Maybe he's been regurgitating this same talking point since the 80's and never bothered to check if it's still true. Maybe, like you guys, he heard someone else say it and thought, "HEY, that fits with my preconceived notions, it must be true!" Either way it's a lie, and possibly one told on purpose.

[Edited on March 21, 2012 at 1:01 PM. Reason : .] 3/21/2012 12:51:45 PM 3/21/2012 12:51:45 PM

|

eyewall41

All American

2251 Posts

user info

edit post |

OWS and the taking of Union Square:

http://occupiedmedia.us/2012/03/union-square-occupied/  3/21/2012 1:00:54 PM 3/21/2012 1:00:54 PM

|

d357r0y3r

Jimmies: Unrustled

8198 Posts

user info

edit post |

Yep, I was wrong. So when silver was at its high, gas was like...2.60 - 2.90 a gallon. Now it's little less than 4 bucks and silver is somewhere in the 30s.

So, actually - when silver was at its high - a silver dime (which comes out to something like .07 ounces of silver, a little more actually) was worth about $3.50. It was worth significantly more than a gallon of gas. Now, a dime is worth closer to $2.62.

Again, nothing wildly inaccurate here. Obviously, a 1-1 gas/silver dime ratio is not going to be a stable exchange rate.  3/21/2012 1:07:31 PM 3/21/2012 1:07:31 PM

|

MattJMM2

CapitalStrength.com

1919 Posts

user info

edit post |

Delete

[Edited on March 21, 2012 at 1:29 PM. Reason : new post]  3/21/2012 1:13:40 PM 3/21/2012 1:13:40 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

edit: I saw that, but I'll spare you

The silver price high was 48.58 on ~May 1st, 2011, putting a silver dime at 3.51

Around that time, gas was around 3.20, not "2.60-2.90"

I'm just eyeballing that chart, but it looks like a dime bought a gallon for about 2 weeks, tops, and never would have happened without the silver spike which was obviously artificially inflated. I'm not sure if he ever actually said it during those 2 weeks.

| Quote : | | "Again, nothing wildly inaccurate here." |

Uh, yes, it's still inaccurate, disingenuous and downright deceitful to make a claim that was only valid for, at most two weeks in the past 10 years, and to keep making that claim over and over again years after.

[Edited on March 21, 2012 at 1:27 PM. Reason : .] 3/21/2012 1:17:16 PM 3/21/2012 1:17:16 PM

|

d357r0y3r

Jimmies: Unrustled

8198 Posts

user info

edit post |

| Quote : | | "So, actually - when silver was at its high - a silver dime (which comes out to something like .07 ounces of silver, a little more actually) was worth about $3.50." |

| Quote : | | "the last time "A silver dime can buy a gallon of gas" was true was probably more than a decade ago at least. " |

Wrong.

I didn't remember hearing Ron Paul say this, but I did find it in the September 7th, 2011 debate. Guess what the price of silver was at that time? About 41/ounce. Silver dime comes out to just at 3 dollars.

[Edited on March 21, 2012 at 1:26 PM. Reason : ] 3/21/2012 1:19:04 PM 3/21/2012 1:19:04 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

| Quote : | | "I didn't remember hearing Ron Paul say this," |

He said it most recently less than two weeks ago, I posted the link earlier to a youtube video of him being interviewed on (I think) Fox.

| Quote : | " but I did find it in the September 7th, 2011 debate. Guess what the price of silver was at that time? About 41/ounce. Silver dime comes out to just at 3 dollars.

" |

Yeah, and a gallon of gas came out about $3.60. So no, even at the height of silver price it still did not buy a gallon of gas.

How much stretching are you going to do before you just admit it's a flimsy talking point that sounds catchy but is a little light on the truthfulness? He used the present tense both in 2011 and again just this month, and it was true neither time.

[Edited on March 21, 2012 at 1:49 PM. Reason : .] 3/21/2012 1:28:43 PM 3/21/2012 1:28:43 PM

|

MattJMM2

CapitalStrength.com

1919 Posts

user info

edit post |

Yes, I'll concede that RP was inaccurate in his claim about exactly 1 dime will buy exactly a gallon of current gasoline.

However, his point is still valid about the Fed debasing the value of the dollar and it's affect on the price of gasoline. Not really sure how you can contend otherwise.

Sure, RP is a politician, which means he has to speak in a way that influences and catches the attention of his audience...

Would it have been more accurate for him to say the price of gas would be 1.52 Dimes? Yes. But it was on off the cuff answer to illustrate his point about the negative implications of the fed.

[Edited on March 21, 2012 at 1:33 PM. Reason : writing skillz need work.]  3/21/2012 1:31:41 PM 3/21/2012 1:31:41 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

| Quote : | | "However, his point is still valid about the Fed debasing the value of the dollar and it's affect on the price of gasoline. Not really sure how you can contend otherwise." |

I never contended that, again you're trying to broaden the debate to take the spotlight off Paul's fib and your believing/rationalizing of it.

| Quote : | | "Sure, RP is a politician, which means he has to speak in a way that influences and catches the attention of his audience..." |

He has to lie sometimes, just come out and say it, this is the first step of recovery.

| Quote : | | "But it was on off the cuff answer to illustrate his point about the negative implications of the fed." |

It's not "off the cuff" when you repeat it, and you're lying to yourself if you think he even said it off the cuff at that debate, as though he doesn't get just as much coaching as the other candidates.

It doesn't exactly make your point very credible if to illustrate it you have to lie and exaggerate its impact. There's a few names for this tactic, and they tend to end in "-mongering"

If the point's so valid, if the issue's so important, then exaggeration shouldn't be necessary.

[Edited on March 21, 2012 at 1:48 PM. Reason : .] 3/21/2012 1:37:02 PM 3/21/2012 1:37:02 PM

|

d357r0y3r

Jimmies: Unrustled

8198 Posts

user info

edit post |

If you really want to get into specifics, physical silver sells for significantly more than spot silver has it at. This is because buyers and dealers know the upside.

You don't care about that, though. This was an opportunity to prove Ron Paul wrong, no matter how trivial a point it was and how badly you missed the forest for the trees.  3/21/2012 1:40:26 PM 3/21/2012 1:40:26 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

I don't give a shit because you'll say literally anything to rationalize what he said. I'm surprised you haven't taken the "Well the coin's COLLECTOR value is much higher..." route, to be honest.

And your "forest through the trees" talk falls on dead ears since we just proved that you, Genius, Matt, all of RP's fans, and RP himself have an exaggerated picture of the effect of inflation in their heads.

I mean really, I had to spend a whole page debunking it before you guys finally started to admit he exaggerated. That says something about your expectations and your confirmation bias. Worst of all, it says something about credibility, since none of you made a serious effort to fact-check it until I pushed, what's that say about the other rumors you spread, thinking they're true?

So don't expect me to take your inflation-mongering much more seriously after this episode where you proved just how distorted your intuition is on this issue.

[Edited on March 21, 2012 at 1:51 PM. Reason : .]  3/21/2012 1:46:09 PM 3/21/2012 1:46:09 PM

|

d357r0y3r

Jimmies: Unrustled

8198 Posts

user info

edit post |

You were wrong in a major way, though. You're revealing your bias.

Let me spell this out for you. The metal contained in a pre-1964 dime - that is, ten cents - has fluctuated in value between 2 and 4 dollars in the past two years. You would have to be a complete imbecile to think that Ron Paul was claiming that a gallon of gas is pegged to the value of a silver dime.

The entire fucking point is that the metal value of a 10 cent coin has, in the past fifty years, been multiplied by a factor of 10-40 in terms of dollars. You don't have a problem with this. You see inflation as a good thing, or on other days, as something that doesn't even exist. We all understand that. It doesn't change the fact that the price of metal in terms of dollars has gone way, way up. You're being intentionally dense.  3/21/2012 1:55:38 PM 3/21/2012 1:55:38 PM

|

Str8Foolish

All American

4852 Posts

user info

edit post |

| Quote : | | "Let me spell this out for you. The metal contained in a pre-1964 dime - that is, ten cents - has fluctuated in value between 2 and 4 dollars in the past two years." |

By "4 dollars" you mean 3.52 but whatever. Even now you're trying to gently nudge the numbers in a favorable direction, give it up already. And for the record, 2 years ago it was only worth about $1.20.

You can look back on the 20 year as well. It's clear there's more than inflation to blame for the current prices, the only question is if the bubble bursts like it did in '80 or if it'll reach even higher first.

| Quote : | | "You would have to be a complete imbecile to think that Ron Paul was claiming that a gallon of gas is pegged to the value of a silver dime." |

Nobody thinks that, you're trying to find a strawman to beat now, good job finding one.

| Quote : | | "The entire fucking point is that the metal value of a 10 cent coin has, in the past fifty years, been multiplied by a factor of 10-40 in terms of dollars. " |

That's your point, and nobody's contesting it.

Paul, however, was responding to a question about gas prices, and instead of saying something intelligent about it, he tried to pull things back to monetary policy, which, if we look at the inflation-vs-gas graph, clearly doesn't tell the whole story.

And regardless of the "point" of what he said, he told a lie and his legions repeated it without fact-checking. A lie that distorts and exaggerates the actual impact of inflation. I find it incredibly ironic you think this is so trivial. If we went over the global warming thread and I made a statement about temperature or sea levels that was off by a similar proportion, you'd be crawling up my ass for pages.

| Quote : | | "You don't have a problem with this. You see inflation as a good thing, or on other days, as something that doesn't even exist. We all understand that. " |

More strawmen ahoy. I've never said it didn't exist, only that it's less severe than you and other Paulite inflationistas make it up out to be (which is correct, especially in this case where we have direct proof that your intuitions on its severity are exaggerated).

| Quote : | | "It doesn't change the fact that the price of metal in terms of dollars has gone way, way up. " |

That fact was never in question, but the importance of that fact depends on the severity of that price increase. If you bend over backwards to defend an exaggerated depiction of the severity, what does that say about the importance? A little intellectual honesty, and acknowledging that inflation is something less than apocalyptic, will get you a lot further than throwing loose (incorrect) figures around and exaggerating with the hope that nobody will fact-check.

| Quote : | | "You're being intentionally dense." |

A very specific claim was made, I proved that claim false, now you're trying to pretend we've been talking about a broader issue this whole time.It doesn't make me "dense" that I wont let you pull every debate out of reality and into the abstract realm so those pesky "facts" don't get in the way.

Of course, this could have all ended early if you'd just said, "Yeah, clearly Paul's exaggerating and that statement is not true. Moving on, let's talk about inflation anyway." but you instead tried to twist and spin what he said into something true-ish, and failed over and over again to do so.

This is why nobody takes Paul seriously outside of his fans: He and everyone associated with him are so concerned with cheerleading, back-patting, and tribalism to discuss issues with anything resembling objectivity, far, FAR worse than the Obamabots of 2008.

.

[Edited on March 21, 2012 at 2:54 PM. Reason : .] 3/21/2012 2:47:46 PM 3/21/2012 2:47:46 PM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

The Dallas Fed: Break up "too big to fail" banks or another crisis will occur, oh yeah, and Dodd-Frank sucks.

http://www.dallasfed.org/assets/documents/fed/annual/2011/ar11.pdf

A pretty even-handed anaylsis, worth a quick skim.  4/4/2012 7:51:22 PM 4/4/2012 7:51:22 PM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

US Bank closes UC Davis branch, cites "intolerable" Occupy protests

Minneapolis-based US Bank is mad as hell about UC Davis' Occupy protests, and executives aren't going to take it anymore.

Citing the "intolerable" situation created by the daily protests outside the bank's doors, US Bank officials abruptly closed the US Davis branch location at the end of February, ending an agreement with the school that generated upward of $170,000 annually for student activities.

In a letter to officials at the Sacramento-area university, US Bank Senior Vice President Daniel Hoke said the bank had been "constructively evicted" and that its employees were "effectively imprisoned" by the protesters.

http://blogs.citypages.com/blotter/2012/03/us_bank_closes_uc_davis_branch_cites_intolerable_occupy_protests.php

Wow, occupy scored one  4/8/2012 3:26:03 PM 4/8/2012 3:26:03 PM

|

aaronburro

Sup, B

52682 Posts

user info

edit post |

yep. gotta love people preventing other people from going to work. nothing illegal about that  4/8/2012 3:30:36 PM 4/8/2012 3:30:36 PM

|

GeniuSxBoY

Suspended

16786 Posts

user info

edit post |

Nothing says you can't occupy the occupiers, aaronburro.

Go put the occupiers out of business.  4/8/2012 3:33:18 PM 4/8/2012 3:33:18 PM

|

Krallum

56A0D3

15294 Posts

user info

edit post |

I occupy this shit without words

I'm Krallum and I approved this message.  4/9/2012 12:18:22 AM 4/9/2012 12:18:22 AM

|

The E Man

Suspended

15268 Posts

user info

edit post |

just shows how weak the occupiers are and how much of a chokehold the banks really have on society. occupiers can only lose by winning and lose if they don't win as well. they either lose, lose or lose.  4/9/2012 2:59:08 AM 4/9/2012 2:59:08 AM

|

IMStoned420

All American

15485 Posts

user info

edit post |

This was a stupid use of their time. Not only did they get the people who worked at this bank laid off, they also lost the school $3 million in revenue. I've never even heard of US Bank before. What exactly did this accomplish?  4/9/2012 8:43:39 AM 4/9/2012 8:43:39 AM

|

Pupils DiL8t

All American

4907 Posts

user info

edit post |

Is there any direct action planned in Raleigh for May 1st?

[Edited on April 20, 2012 at 1:31 AM. Reason : grammar]  4/20/2012 1:06:26 AM 4/20/2012 1:06:26 AM

|

Pupils DiL8t

All American

4907 Posts

user info

edit post |

http://www.pbs.org/wgbh/pages/frontline/money-power-wall-street/  4/24/2012 10:28:14 PM 4/24/2012 10:28:14 PM

|

moron

All American

33717 Posts

user info

edit post |

| Quote : | | "This was a stupid use of their time. Not only did they get the people who worked at this bank laid off, they also lost the school $3 million in revenue. I've never even heard of US Bank before. What exactly did this accomplish?" |

You sound like republicans who complain about the size of government, then when cuts are made, complain about the loss of services and jobs. 4/24/2012 10:55:58 PM 4/24/2012 10:55:58 PM

|

eyedrb

All American

5853 Posts

user info

edit post |

^are you kidding? You dont see a difference?  4/25/2012 8:49:28 AM 4/25/2012 8:49:28 AM

|

eyewall41

All American

2251 Posts

user info

edit post |

Pupils I think all the local occupy groups are going to Durham for May 1st.  4/25/2012 3:55:20 PM 4/25/2012 3:55:20 PM

|

TerdFerguson

All American

6570 Posts

user info

edit post |

a good perspective from someone I wouldn't think is usually associated with Occupy

http://www.neh.gov/about/awards/jefferson-lecture/wendell-e-berry-lecture  4/25/2012 8:06:39 PM 4/25/2012 8:06:39 PM

|

Pupils DiL8t

All American

4907 Posts

user info

edit post |

Just read that striking workers shut down LAX.   5/1/2012 4:58:47 PM 5/1/2012 4:58:47 PM

|

eyewall41

All American

2251 Posts

user info

edit post |

Despite the media blackout and/or grossly underestimated numbers this is what it looked like on Broadway in NYC for May Day (Note: another major march was happening at the same time on 5th ave.): http://www.youtube.com/watch?v=2r1dqXLstg4  5/2/2012 9:47:04 AM 5/2/2012 9:47:04 AM

|

IMStoned420

All American

15485 Posts

user info

edit post |

OMG this is going to be a fun summer and election.  5/2/2012 1:15:49 PM 5/2/2012 1:15:49 PM

|

Pupils DiL8t

All American

4907 Posts

user info

edit post |

Part 2 of the video posted ^8 has been posted.

[Edited on May 3, 2012 at 12:10 AM. Reason : http://www.pbs.org/wgbh/pages/frontline/money-power-wall-street/]  5/3/2012 12:09:23 AM 5/3/2012 12:09:23 AM

|